My view of the industry post covid

Editor's note: Mr. Duane Kuang is a TMTPost columnist and a Founding Managing Partner of Qiming Venture Partners and a member of the Investment Committee. Duane has over 30 years of operational and investment experience and started his venture capital career since 1999.

On May 12th, a few days after the city of Beijing lifted quarantine requirments for domestic travellers since COVID, I was on a flight from Shanghai to Beijing. Every seat on that plane was filled. Everyone wore facial masks, but people did not seem to be overly concerned. As I was standing in the ailes among all the business looking passengers waiting to deplane, I couldn’t help but feel a sense of optimism for the future.

In 2003, when SARS hit, I was living in Hong Kong but covered China in my role as the head of Intel Capital China. I also resumed business travel right after restriction was lifted, and I still remember the return flight for that first trip, from Beijing to Hong Kong on June 14th, 2003. The plane was half empty. No one was talking and there was an eerie feeling in the air. I remember it vividly because that date was my 40th birthday.

For some reason, this time it felt very different. While I do not want to downplay the significance of the COVID-19 pandemics, I am optimistic about the resilience of the Chinese entrepreneurs. There will be opportunities that come about because of or despite the pandemic.

In the healthcare area, the pandemic will create near term to medium term opportunities that combat the virus, including developers of vaccine, test equipment or treatment drugs. We are seeing business volumes double, triple or in some cases 10x the original forecast of some of these companies in our portfolio. But the impact on healthcare is much more fundamental.

Healthcare as a percentage of national output will increase post the pandemic. There will be far more investment into the pharma, devices and testing areas where private enterprise play a significant role. There will also be much more attention paid to medtech companies which demonstrated their unique abilities during this pandemic, whether they are AI companies or online healthcare providers. In the service area, there will also be more investment, but the jury is still out which direction policy makers will turn when it comes to the role private enterprises and hence private equity investment play.

One may argue that the reason for China’s success was largely due to the public hospital system and the state’s ability to mobilize healthcare resources nationwide during the pandemic, and therefore, China should strengthen the public hospital system at the expense of private healthcare.

As a free market advocate, I see it differently. While the bedrock of China’s healthcare service has to be the public system, private healthcare can be leveraged to augment the public system by alleviating pressure on the public system, by providing more market oriented rewards to medical staff so young talents will continue to come into the profession, and even to provide a worthy competitor so the public system needs to constantly improve.

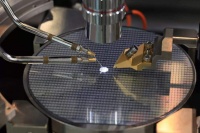

On the technology side, we already see the role information technology play during the shut down period.

While the demand for online meetings will decrease once the pandemic subsides, much of the demand for the underlying technology will become permanent. For example, companies providing cloud infrastructure, streaming infrastructure and network security will continue to see high demand. More importantly, enterprise software companies providing HR Management, Supply Chain Management, Customer Relationship Management and ERP will see fundamental behavior shift by customers embracing these solutions.

This will drive the growth of the enterprise software market in China. While online gaming and e-commerce saw tremendous growth post-SARS, I expect the elusive dream of a thriving enterprise software market will finally materialize as a result of the behavior shift during the pandemic.

As an early stage healthcare and TMT investor, Qiming is well positioned to capture the growth in the China market post-COVID. We have successfully raised our latest US dollar fund. We have built up a strong reputation and a top-notch team in both the healthcare and TMT areas where we see exciting growth in the upcoming years. Last but not least, our optimism and conviction to the China market will resonate with the many entrepreneurs that see every adversity as an opportunity to thrive.

(Anyone willing to contribtute and have specific expertise, please contact us at: english@tmtpost.com)

相关推荐

My view of the industry post covid

苹果“Find My iPhone”立功,帮警察追踪偷车嫌犯

用游戏化装置测量体温,「Ksubaka」想要在COVID时期提升零售商店用户体验

全球网络峰会与“清零竞赛 Race to Zero”和“我为地球养老基金 Make My Money Matter”携手合作

李佳琦要注册“oh my god 买它买它”声音商标 成功率多高?

和自动驾驶大佬聊聊:谷歌、特斯拉、滴滴自动驾驶哪家强?

36氪首发 | 对标永旺my basket,社区生鲜便利店「云菜园」获数千万元 A+ 轮融资

没有护城河的 Zoom,应该如何用好手上的空白支票?(上)

美国科技巨头们想从疫情中得到什么?

特斯拉老板的房子不值钱?

网址: My view of the industry post covid http://www.xishuta.com/zhidaoview10406.html

推荐专业知识

- 136氪首发 | 瞄准企业“流 3926

- 2失联37天的私募大佬现身,但 3217

- 3是时候看到全球新商业版图了! 2808

- 436氪首发 | 「微脉」获1 2759

- 5流浪地球是大刘在电力系统上班 2706

- 6招商知识:商业市场前期调研及 2690

- 7Grab真开始做财富管理了 2609

- 8中国离硬科幻电影时代还有多远 2328

- 9创投周报 Vol.24 | 2183

- 10微医集团近日完成新一轮股权质 2180